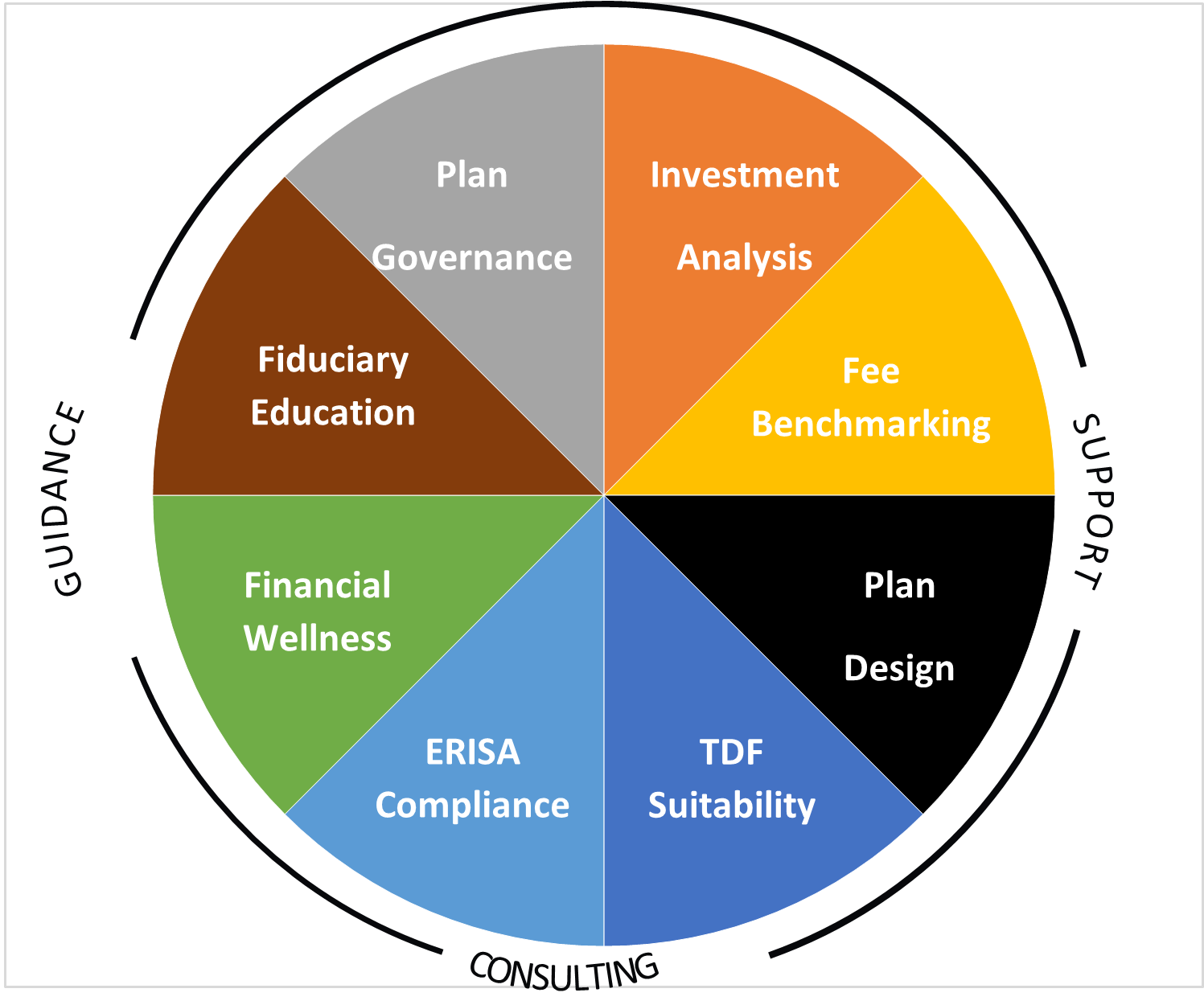

How We Help You

A retirement plan sponsor must act as a prudent expert under the Employee Retirement Income Act of 1974 (ERISA), and is held to a fiduciary standard of care on plan-related decisions about investments, service providers, plan administration, and general ERISA compliance issues. We help plan sponsors fulfill their ERISA fiduciary obligations.

A retirement plan sponsor must act as a prudent expert under the Employee Retirement Income Act of 1974 (ERISA), and is held to a fiduciary standard of care on plan-related decisions about investments, service providers, plan administration, and general ERISA compliance issues. We help plan sponsors fulfill their ERISA fiduciary obligations.

Plan Design and Installation

Plans come in many types. Our mission is to assist you in your quest for a plan that achieves your company’s goals. Whether your primary objective is to reward key employee performance or provide a comprehensive benefit for all employees, we are available to review various design and administration alternatives, including:

- Profit Sharing (traditional, integrated, age-weighted, and cross-tested) • 401(k) (Traditional, Safe Harbor, and individual)

- Defined Benefit (Traditional and Fully Insured)

- Cash Balance

We also provide information and resources to guide you in solving important plan design challenges such as elective and matching contributions, vesting, Qualified Default Investment Alternatives, and voluntary and automated enrollment. When a custom plan design is desired, we provide a menu of unaffiliated third party service providers to assist you in creating a plan that meets the needs of your participants and to provide plan administration service

Provider Analysis

Selecting a suitable investment provider for your plan is important. Evaluating the services and expenses of multiple providers can be complicated and overwhelming for a plan sponsor. Let us streamline the process for you with our LIVE bid RFP search engine:

- Comparative Analysis of Features and Costs

- Responses address Plan Complexity and Service Needs

- Isolate and Compare Provider Differences in Key Areas

- Effective RFP Tool

- Provider Analysis Recommended Every Three to Five Years

- If you decide to convert your plan to a new vendor platform, we can:

- Provide vendor materials regarding the new product and services

- Provide educational information about the investment alternatives you are considering and the appropriateness of mapping

- Act as your liaison with the investment record keeping and service providers

Investment Selection and Review

An established investment strategy is critical for a retirement plan. Our approach combines sophisticated, institutional measurement techniques with an easy to understand 10-point pass/fail scoring process.

We provide responsible plan fiduciaries with access to reports to assist them in evaluating whether their chosen investment options meet the plan’s investment policy requirements. These reports include:

- Fiduciary Investment Review

- Target Date Fund (TDF) Analyzer

- Investment Policy Statement

We also make available the following investment-related educational services:

- Asset allocation. Educational tools and resources so you can set your own appropriate mix of asset classes and investment styles to address your investment goals and life-stage challenges.

- Manager evaluation and selection. Third party tools to help research, evaluate and select a diversified, cost-effective lineup of active and passive investment options. We make available third-party ERISA 3(21) or 3(38) fiduciary support as needed or desired.

- Qualified Default Investment Alternative (QDIA) evaluation. Research assistance and information to help you evaluate QDIA options available under your investment platform so you may select QDIA options which meet the suitability requirements for participants who either do not make investment elections or enroll automatically.

- Investment Reviews. Quarterly or annual reviews of the plan’s investments so you can evaluate performance, risk characteristics and expenses of such investment options, and provide information on alternative funds selected by you to assist you in determining whether changes may be appropriate.

- Managed portfolios. Diversified portfolios of investments for participants using off-the-shelf or customized asset allocation models created and managed by ERISA 3(38) investment managers to aid you in fulfilling your fiduciary obligation regarding those portfolios.

- Retirement income planning. Investment education and tools to pre-retirees or those approaching age 70½ to assist them evaluate their retirement-income needs and implement strategies for managing, spending, and investing voluntary or mandatory distributions from their retirement accounts.

- Participant-level services. Investment education and tools to participants to help them evaluate their retirement savings goals and implement appropriate contribution and investment decisions.

Employee Education

- Employee enrollment. Lead, co-present, and arrange enrollment meetings and provide vendor approved online and printed educational materials to encourage participation.

- Participant plan fee education. Information on plan fees and communication of the plan’s requirements for requesting additional information about plan fees and expenses.

- Retirement Readiness. Periodic education programs addressing the employee’s larger financial concerns, such as retirement planning and college costs.

- Planning tools. Access to online or offline retirement planning tools to help participants make appropriate contribution and investment election decisions.

- ERISA 404(c) education. Information provided by third party vendors on the plan’s investment options.

Services to Plan Sponsors

- Fiduciary audits. Assist you with your review of the plan so you may assess whether you are in compliance with ERISA’s fiduciary requirements and help you identify areas requiring attention.

- Documentation. Help you establish an Inspection Ready ERISA file to properly store appropriate files and document specific decisions about their retirement plans.

- Plan benchmarking. Comparison of a plan’s services, investments, features, and fees versus those of comparable plans in similar-sized organizations.

- Fiduciary education. Educational resources to help you i) understand and meet your fiduciary obligation for reviewing fees and services, ii) identify procedures for tracking the receipt and evaluation of ERISA 408(b)(2) disclosures, and iii) meet the plan participant 404(a)(5) fee disclosure requirements.

- Participation communication requirements. Help you develop procedures to satisfy your obligation to respond to participant requests for additional information.

- Fee reporting and analysis. Detailed listings and explanations of all fees paid by the plan and participants to all service providers, advisors, and investment companies, and identification of appropriate opportunities for cost savings.

- ERISA 404(c) compliance review. Help you transfer liability and responsibility of investment decisions to plan participants by guiding the development of appropriate participant education and communication strategy in order to comply with 404(c).

- ERISA 3(16) administrative services. Availability of third-party fiduciaries to assist plan sponsors meet their responsibilities for the administration of the plan, such as ERISA reporting and disclosure.

- ERISA 3(21) investment advice. Availability of third-party fiduciaries to advise plan sponsors on evaluating, selecting, monitoring, and replacing plan investments on a continuous basis. • ERISA 3(38) investment management. Availability of third-party fiduciaries to manage participant investments for those participants choosing to contract for those services.

Our services include:

Our services include:

- Plan Design to meet your objectives

- Vendor Selection

- Fiduciary Management and Advisory Services

- Investment Selection and Monitoring

- Provider and Fee Benchmarking

- Participant education

We measure our success on your employees’ ability to replace their current income in retirement and to retire on time. Our process drives active participation and retirement readiness, while helping to manage the complexities of running a defined contribution plan